Digitalization is increasing the use of E-wallets in many countries. In Vietnam, the adoption of the MOMO e-wallet is significantly rising. The aim of this paper is to analyze the determinants affecting the Vietnamese use of MOMO e-wallet, a major player in this domain. The study uses a quantitative research method with data collected from 138 MOMO E-wallet users. Various frameworks including the Technology Acceptance Model (TAM) and the Unified Theory of Acceptance and Use of Technology (UTAUT) are explored to examine the technology acceptance and use of e-wallets.

The results of the study identified perceived usefulness, ease of use, social influence, mobility, and convenience as key determinants of E-Wallet Adoption in Vietnam.

Technology Acceptance and Behavioral intention

MOMO e-wallet (Mobile Money), a leading mobile wallet provider in Vietnam, has over 13 million members and a strong reputation for promptness and dependability (MOMO, 2020). MOMO has partnered with major international payment institutions like Standard Chartered, JCB, MasterCard, and Visa. With over 10,000 businesses in various industries. MOMO has a total payment value of $1.2 billion annually, exceeding 200 million transactions per year, according to Thuy Dieu (2019).

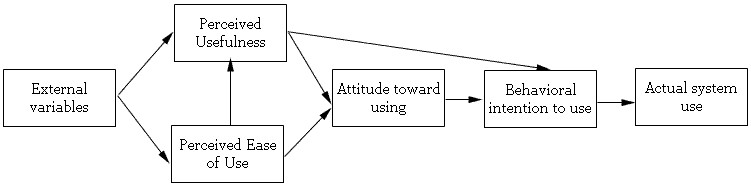

Technology Acceptance Model (TAM), established by Davis (1989) as seen in image 1, is a psychological theory that explains user behavior in the technology industry. It focuses on perceived ease of use (PEU) and perceived usefulness (PU), which influence attitudes towards technology usage. Similarly, Shankar & Datta (2018) found that all components positively influenced the desire to use e-wallets.

However, the model fails to account for environmental restrictions, and its cognitive constructs, perceived usefulness and ease of use, are insufficient for a holistic understanding of technology adoption. The author applied both independent variables for the research.

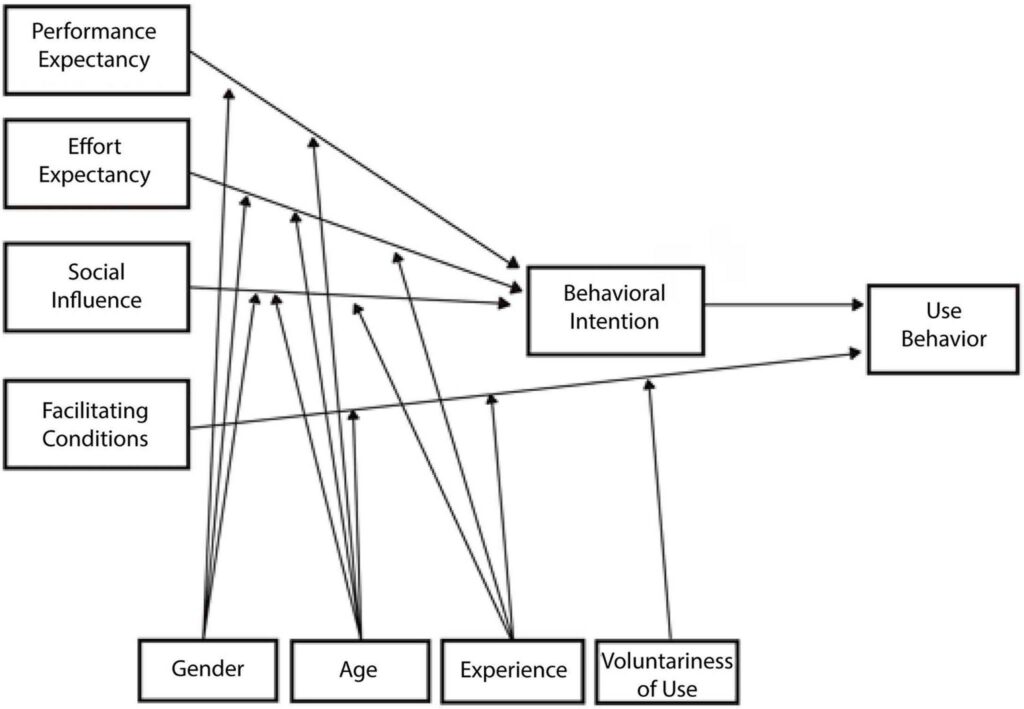

The Unified Theory of Acceptance and Use of Technology (UTAUT), developed by Venkatesh (2003), consists of four components: Performance Expectancy (PE), Effort Expectancy (EE), Social Influence (SI), and Facilitating Conditions (FC).

Williams et al. (2011) and Slade et al. (2015) utilized the UTAUT theory to explore various online payment options, highlighting its practical and theoretical relevance in technology adoption. In the study, social influence is applied for the research framework built by the author, as third independent variables.

Behavioral intention, according to Ajzen (1991), is an intermediate antecedent of behavior and is a good predictor of usage behavior. It is often used in research to assess people’s intentions regarding the adoption of mobile wallets. The Technology Acceptance Model (TAM) and The Unified Theory of Acceptance and Use of Technology (UTAUT) are two theories used to assess intentions regarding mobile wallet adoption.

Hypothesis development

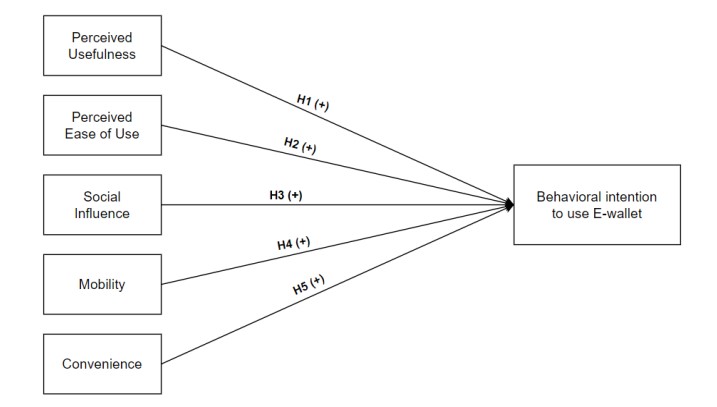

Perceived usefulness refers to a person’s belief in using a system that enhances their job performance (Davis, 1989; Venkatesh et al., 2003). The more customers perceive the benefits and efficiency of mobile payments, the more likely they are to use the service. The usefulness of MOMO e-wallets, such as account recharge, money transfer, and bill payment, is a critical factor in influencing mobile banking app adoption. The first hypothesis is as follow:

H1: Perceived usefulness positively affects behavioral intention to use MOMO e-wallet in Vietnam.

Perceived ease of use refers to a person’s belief in the ease of using a system. Studies show a positive correlation between ease of use and behavioral intention to use, with e-Wallets optimizing registration processes to attract users (Venkatesh et al. , 2002). The author suggests that the ease of use is crucial for customers to adopt modern technology, especially for MOMO. This leads to the second hypothesis stated as follows:

H2: Perceived ease of use positively affects behavioral intention to use MOMO e-wallet in Vietnam.

Venkatesh et al., (2003) highlighted the importance of social influence in customers’ decision-making process, highlighting the influence of friends, family, and social networks on their purchasing decisions. Social influences from influential individuals can alter an individual’s intentions, leading them to adapt their behavior to the use of digital wallets. From this point of view, the third hypothesis is as follows:

H3: Social influence positively affects behavioral intention to use MOMO e-wallet in Vietnam.

Kalinic and Marinkovic (2015) emphasize the importance of mobility in financial transactions, highlighting the potential for users to access services and complete transactions from anywhere with a network connection. The research indicates that mobility may influence Vietnamese individuals’ intention to use digital wallets, as hypothesized in hypothesis H4.

H4: Mobility positively affects behavioral intention to use MOMO e-wallet in Vietnam.

Sharma & Gutiérrez (2010) define convenience as the ease and comfort of using something, characterized by quickness, accessibility, availability, and flexibility of time and location. Mobile payment services in Vietnam help customers manage time constraints by reducing costs associated with small transactions and eliminating the inconvenience of dealing with coins and currency. The fifth hypothesis is as follows:

H5: Convenience positively affects behavioral intention to use MOMO e-wallet in Vietnam.

From five independent variables mentioned above, the conceptual research framework is conducted by the author as shown in Figure 3 below.

Research Methodology

This study employs a quantitative approach to investigate the factors influencing customer intention towards electronic wallets, involving five steps:

Step 1: The author conducted a study to examine the relationship between perceived usefulness, ease of use, social influence, mobility, convenience, and the intention to use digital wallets.

Step 2: The author designed a survey questionnaire to assess consumer intention about MOMO e-wallet, identify factors affecting intention using a 5-point Likert scale, and gather personal information for sample description. The questionnaire was conducted online in English, using Google Form, and translated into Vietnamese, with 18 questions (or called as 18 observed variables) related to the variables of the study.

Step 3: A pilot test was conducted on a survey to assess its accuracy, grammar, and clarity. The test involved 10 individuals from various age groups, genders, and backgrounds, including author’s colleagues, family members, and friends, who were either current or new users of electronic wallets.

Step 4: The minimal sample size in the EFA approach is five times the number of observed variables, as stated by Hair et al. (1998). The optimal sample size is calculated as N ≥ 5p (N = sample size. 5 = number of independent variables mentioned in the research, p = number of observed variables). Thus, the minimum sample is N = 5*18 = 90.

Step 5: The author sent the online survey with closed-ended statements, disseminating it to participants in Vietnam through Facebook, Skype, and Zalo. The survey was also distributed to friends in Hanoi and central Vietnam. The study collected 155 responses from October 23rd to 28th, 2022. After six days, 17 responses were ineligible due to factors like not using mobile wallets or not using digital wallets. The remaining 138 responses met the criteria and were included in the study for analysis. The study utilized Likert Scales of 5 for each variable related to MOMO e-wallet, measuring participants’ responses and ratings on a scale ranging from 1 = “strongly disagree” to 5 = “strongly agree.”

General findings

The study reveals that the younger generation, comprising 75.4% of the total, is the most active demographic in the MOMO e-wallet market. The majority of respondents are aged 18 to 29, making up a significant portion of the population. When it comes to occupation, it demonstrates that e-wallets have become popular among Vietnamese people, particularly full-time employees, with 67.1%. Additionally, MOMO users are students, freelancers, and self-employed. The monthly earnings of the less than €400 per month group (less than 10 million) in Vietnam are 40.6%, and 43 respondents showed their earnings between 10 and 15 million, exceeding the average monthly income per capita and minimum cost of living in HCMC, indicating that most respondents can sustain a certain standard of living. Regarding the nationwide distribution, the majority of surveyed respondents are from the South, Vietnam’s most prominent economic area. 60.9% and 21.7%, were from the South and Middle, while 17.4% were from the North. The survey focused on MOMO e-wallet users’ activities, with 73.1% using multiple services such as purchasing flight tickets, movie, shopping, and spa services. 47.8% paid monthly bills (electronic, water, internet, lending bills), while 66 respondents used other services.

Hypothesis testing findings

Perceived Usefulness (PU): The study found that users’ perceived usefulness significantly influences their future conduct. The MOMO e-wallet was highly regarded useful by 70% of users, with 64.5% agreeing and 23.9% strongly agreeing. The service’s usefulness was validated by 37 users and 82 users, with 26.8% and 59.4% respectively. 63% of users agreed that the MOMO wallet positively impacted their daily activities, while 23.9% saw greater applicability in payment completion. The rapidity of receiving updated information on their accounts was also a significant factor, with 72.5% agreeing. Overall, MOMO ewallet’s usefulness is widely acknowledged in Vietnam.

Perceived ease of use (PEU): The ease of use of MOMO wallets significantly influences consumer intention. Most customers express satisfaction with the convenience and simplicity of using the wallet service. 26.8% agree and 60.1% strongly agree that it is feasible for them to become proficient in using mobile wallets quickly. 112 users agree that they can learn to use the wallet app with low effort and take little time, indicating confidence in MOMO. The third and fourth statements received favorable feedback, focusing on the simplicity of processes when asking for requests and interactions. However, 2.2% of respondents disagreed with the first two assertions, and 2.2% disagreed with the second statement, indicating that the simplicity of transactional processes does not motivate their desire to use MOMO.

Social influence: It is found that social influence positively influences the desire to use a mobile wallet. Users cited the comfort and familiarity with using mobile wallets from their peers as a motivation. However, a significant number of users disagreed with the influence of family members on their intention, with 10.9% disagreeing and 17.4% completely disagreeing. Advertising had a neutral impact on 27.5% of consumers, suggesting that individuals seek guidance from those of similar age, interests, and lifestyles. Overall, the community’s familiarity with mobile wallets is a significant factor in adoption.

Mobility: The MOMO electronic wallet’s mobility has been widely accepted by users, with 23.2% agreeing and 54.3% completely agreeing. 41.3% said they could use the app while traveling. Over 80% agreed, with 27.5% agreeing and 58% completely agreeing. However, only 3.6% disagreed, questioning the app’s suitability for smartphone users who never leave their devices. Despite this, the majority of users gave favorable responses, with the number of disagreed users lower than the number of favorable responses.

Convenience: The MOMO e-wallet has been found to positively impact behavioral intention among users, with 23.9% of them agreeing and 58% strongly agreeing. Collaboration with convenience stores can expand services and increase accepted payment types, allowing consumers more freedom in bill settlement. 56.5% of respondents agree that MOMO wallets can be used for daily living expenses like water, power, and internet. The majority of respondents agree that they can use MOMO for online purchases, with more opportunities for use as more establishments accept mobile wallet payments.

Based on the results of the hypotheses testing, it can be concluded that perceived ease of use, social influence, mobility, and convenience are the five criteria influencing behavioral intention to use MOMO e-wallet in Vietnam, as per the test results.

| Behavioral intention | Conclusion |

|---|---|

| PU => Behavioral intention | H1 is supported |

| PEU => Behavioral intention | H2 is supported |

| SI => Behavioral intention | H3 is supported |

| MOB => Behavioral intention | H4 is supported |

| CON => Behavioral intention | H5 is supported |

Recommendations

From the above results, the author recommends MOMO e-wallet to meet consumer demands and accelerate electronic payment industry development in Vietnam. The most influential factor in consumers’ intention to use MOMO e-wallet is the perception of efficiency. To improve efficiency and convenience, MOMO should understand expanding e-payment needs and integrate payment utilities in various fields. Additionally, MOMO should integrate e-wallet into automatically search and pricing suggestion gadgets to help customers save time and money.

MOMO needs to enhance its credibility to maintain customer reliability, as perceived reliability is the second most important factor in their intention to use MOMO e-wallet in Ho Chi Minh City. This requires continuous improvement in security and safety of user accounts, upgrading the password matrix (VITOS) for password authentication, and promoting its social impacts through media and television advertising, social media ads, and the influence of famous characters. These measures will help prevent hacking and minimize the exposure of password and account information.

Conclusion

The thesis uses the Technology Acceptance Model (TAM) and Unified Theory of Acceptance and Use of Technology to measure consumer behavioral intentions about wallet applications. Five hypotheses were modified, and demographic data showed gender, age, occupation, and income did not affect users’ intentions.

E-wallets are a crucial service for social growth, addressing consumer expectations for quick transactions. MOMO’s e-wallet application is a successful investment channel, diversifying goods and services. To meet customer needs, MOMO should streamline registration, diversify features, increase partners and payment acceptance locations, and lower interbank transfer costs. They can also foster communication, work with press agencies, and focus on creating and extending mobile application models. This will help MOMO stay competitive and meet consumer’s expectations.